unemployment tax credit update

If you received unemployment benefits in 2020 a tax refund may be on its way to you. 100 Free Tax Filing.

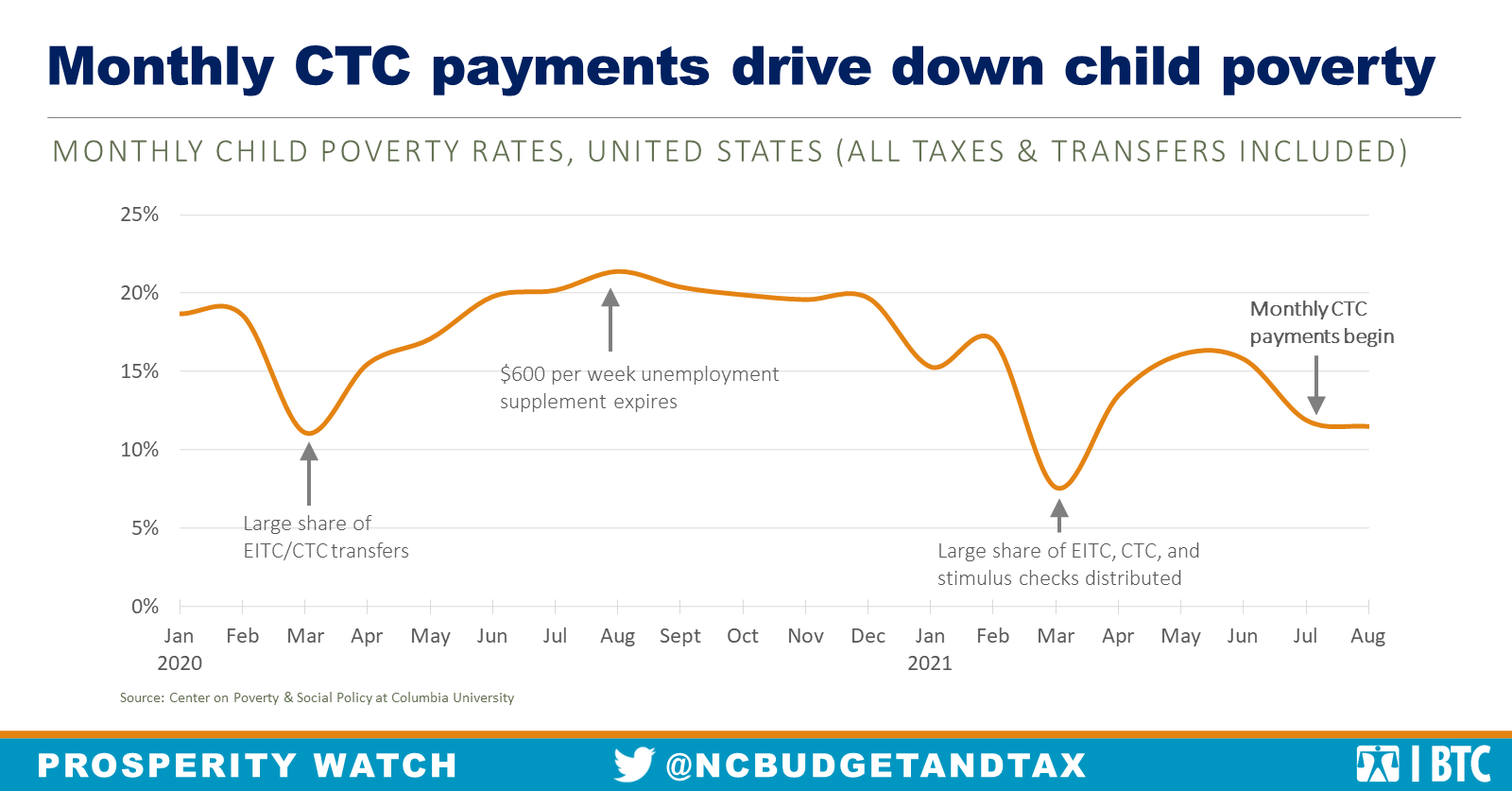

Child Tax Credit Payments Other Cash Benefits Lead To A Decrease In Child Poverty North Carolina Justice Center

Fort Lee NJ 07024 201 308-9520.

. As states end 300 weekly benefit a tax credit could step in for some For some parents advance payments for the 2021 child tax credit in the form of. I filed my 2020 returns on 0312 and received my fed refund and paid my state balance within a week. UNEMPLOYMENT INSURANCE BENEFITS STATE OF NEW JERSEY DEPARTMENT OF LABOR AND WORKFORCE DEVELOPMENT You can receive your unemployment benefits two ways.

2020 Unemployment 10200 Credit Update. The tax exemption for 10200 in unemployment benefits currently only applies to unemployment income you collected in 2020 even though the bill also extended weekly 300. The update did in fact go through and there was a change to my tax.

I am however preparing another return for a friend. Taxpayers whose 2020 income tax returns were revised by the IRS to exclude unemployment benefits from gross income may be eligible for the additional child tax credit or. Property Tax Relief Programs.

If your modified adjusted gross income AGI is less than 150000 the American Rescue Plan Act enacted on March 11 2021 allows you to exclude from income up to 10200 of. Get in Touch. The American Rescue Plan which President Joe Biden signed in mid-March waived federal tax on up to 10200 of unemployment benefits per person.

ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax. Taxpayers eligible for the up to 10200 exclusion who have already filed 2020 taxes claiming their unemployment insurance benefits. We will begin paying ANCHOR.

The deadline for filing your ANCHOR benefit application is December 30 2022. Married couples that fall within. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189.

The refunds will happen in two waves. The ARP states that the 1st 10200 of unemployment received in 2020 is not subject to federal taxes for filers with an adjusted gross income under 150000. He had 3754 in Unemployment and his wife had 34000.

Dont expect a refund for unemployment benefits. I see now that because of the.

:max_bytes(150000):strip_icc()/TermDefinitions_Pandemicemergencyunemploymentcompensation_finalv2-c10a8d7041ba426a934ca5775e75fbed.png)

Pandemic Emergency Unemployment Compensation Peuc During Covid

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Unemployment 10 200 Tax Break Some States Require Amended Returns

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

American Rescue Plan Act Arpa Lowers The Cost Of Health Insurance For Most Washingtonians Better Health Together

Making Child Tax Credit Payments Permanent Debated

Covid 19 Nc Unemployment Insurance Information Des

American Rescue Plan Tax Changes Child Tax Credit Tax Foundation

Over 7 Million Americans Could Receive Refund For 10 200 Unemployment Tax Break

How To Avoid Tax On Up To 10 200 Of Unemployment Benefits The Motley Fool

Work Opportunity Tax Credit Statistics 2021 Cost Management Services Work Opportunity Tax Credits Experts

Unemployment Update Can A Tax Credit Replace 300 Benefit

What Self Employed Workers Need To Know About The Coronavirus Stimulus Package The New York Times